KOMANI PRINCIPAL

CORE ACTIVITIES

a. Credit Financing Scheme.

b. Fixed Deposit Placement.

c. Ar-Rahnu (Islamic Pawn Broking).

d. Debt Management & Collection Services.

e. Product Marketing Services for Co-operative.

ABOUT KOMANI

Koperasi Maal Nizami Negeri Selangor Berhad or KOMANI was established in 2008 as a service cooperative offering

its members consumer credit for various financing products.

KOMANI licensed by Suruhanjaya Koperasi Malaysia and legislated under Malaysia Co-operative Societies Act 1993

(Act 520) with SKM Registration Number: B-4-0496.

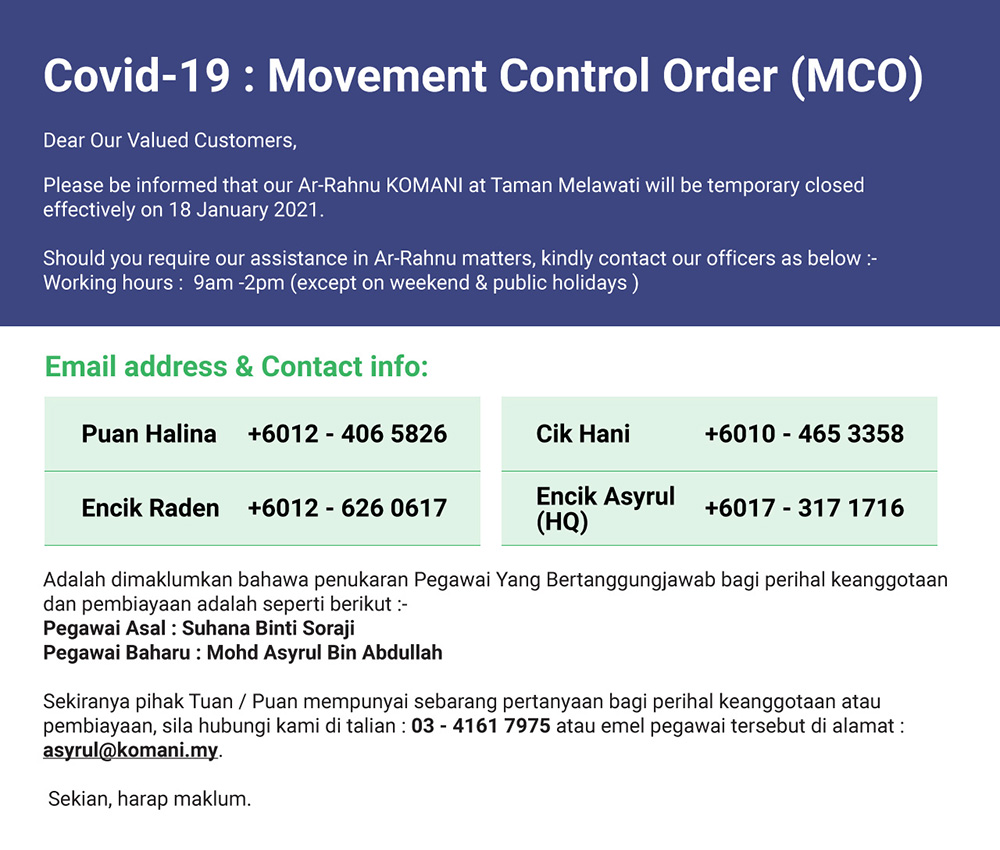

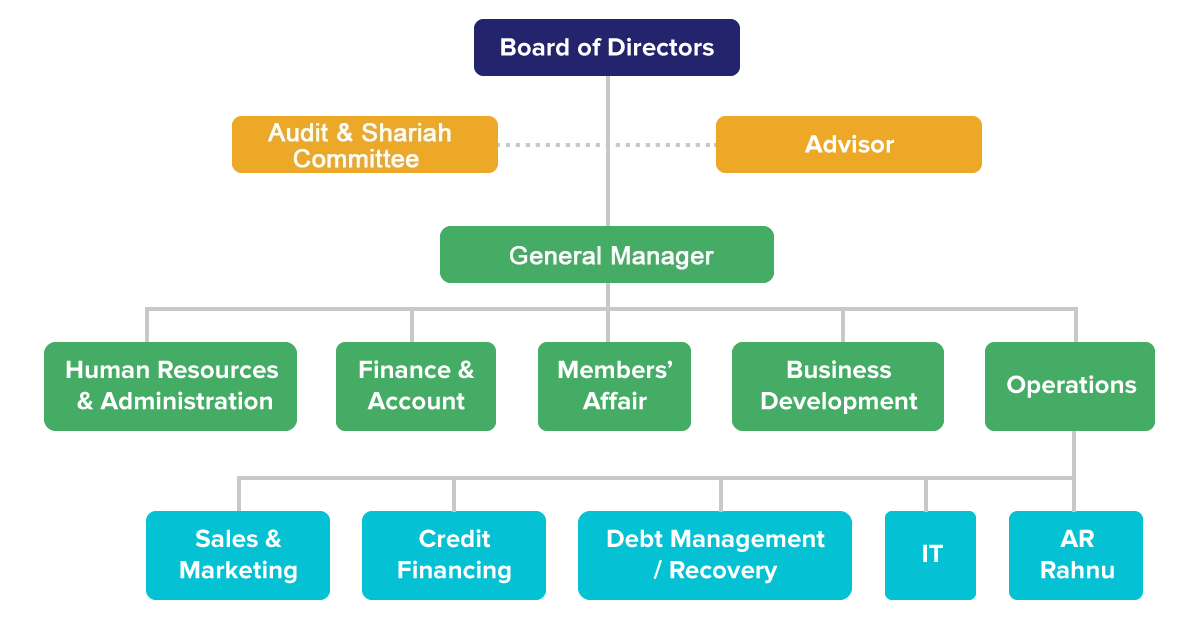

ORGANIZATION CHART

BOARD OF DIRECTORS

PRODUCTS & SERVICES

PERSONAL FINANCING SCHEME |

| Features & Benefits |

| Up to RM200,000 financing |

| 7.99% of financing rates |

| Financing repayment period from 2 years to 10 years |

| *Terms and Conditions apply |

MORTGAGE FINANCING SCHEME |

| Features & Benefits |

| Up to RM500,000 financing |

| 10% of financing rates |

| Financing repayment period from 10 years to 20 years |

| *Terms and Conditions apply |

MICRO FINANCING SCHEME |

| Features & Benefits |

| From RM100,000 to RM500,000 financing |

| 8%-10% of financing rates |

| Financing repayment period from 2 years to 5 years |

| *Terms and Conditions apply |

FIXED DEPOSIT PLACEMENT | |

| Tenure (Month) | Rate |

| 1 | 2.80% p.a |

| 3 | 3.00% p.a |

| 6 | 3.10% p.a |

| 9 | 3.10% p.a |

| 12 | 3.15% p.a |

| *Terms and Conditions apply | |

VISION & MISSION

OUR VISION

“KOMANI envision to become a corporate co-operative leader in Malaysia.”

OUR MISSION

Inspire the developments of co-operatives community with integrity and innovation.

Increase involvement of co-operatives in various economic sectors in Malaysia.

Instill competitiveness and resilient among members in accordance to core values of KOMANI.

CONTACT US

|

Koperasi Maal Nizami Negeri Selangor Berhad Lot A-2-1, Melawati Corporate Centre, Taman Melawati, 53300 Kuala Lumpur. |

|

TEL : +603 – 4161 7975 Fax : +603 – 4162 7975 |

|

info@komani.my |